More than just Gold: 26 Degrees launch Gold Pairs CFD instruments

Riding the wave of surging demand for innovative trading solutions and Gold trading instruments, global multi-asset prime broker 26 Degrees Global Markets have announced the addition of several new Gold Pairs to their existing Pairs CFDs product offering.

As part of this latest expansion, 26 Degrees will enable its broker clients to offer their clients the opportunity to trade Gold (XAU) against various global indices and commodities, including the US 30, US 100, Japan 225, China A50, and US Crude Oil. This latest addition to the Pairs CFDs product range provides traders with an opportunity to tap into the significant interest in Gold in a more targeted way.

"With recent interest rate changes from the Federal Reserve and a looming U.S. election, it would not be a surprise to see volatility surge in both US Indices and Gold in the coming months and these new Pairs bring both factors into play in a single instrument”.

What are Pairs CFDs?

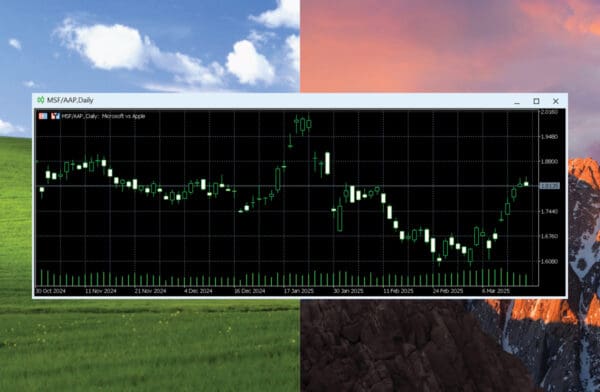

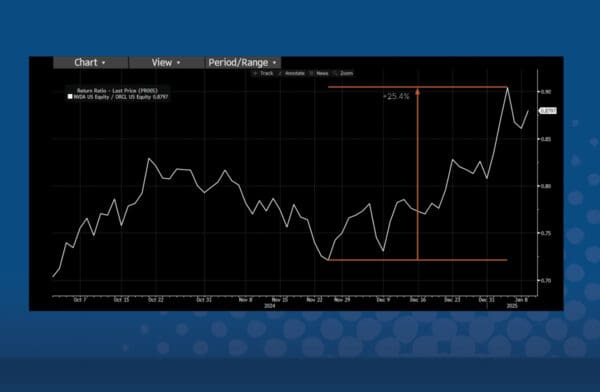

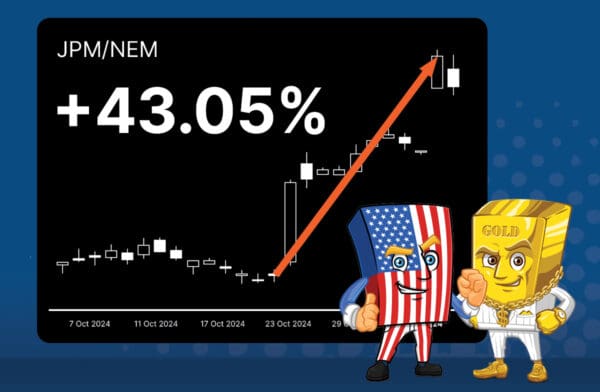

Launched earlier in the year, Pairs CFDs by 26 Degrees are a completely new trading product built in-house for broker dealers, providing traders with the ability to trade any two instruments against each other as a single instrument, just like an FX pair.

Whether that be Metal vs Index, Commodity vs Commodity, Equity vs Equity, Pairs CFDs allow traders to go long in one instrument and short in another, creating a single leveraged position that is treated as a single trade. Importantly, this allows traders to easily set stop loss and take profit levels which are far more complex to set if managing two separate trades. Integration is also simplified due to the ability for Pairs CFDs to be streamed alongside all other 26 Degrees asset classes, via a unified API.

With the US Election around the corner, Pairs CFDs are a powerful tool for traders due to the heightened exposure they can provide around big news events. This presents a significant opportunity for brokers to offer a bespoke suite of highly relevant instruments to their clients and stand out from their competitors.

If you’re interested in finding out more about Pairs CFDs by 26 Degrees, click here

Insights

Latest insights from

26 Degrees