Market Impact: Its importance and how to manage it

In the dynamic world of foreign exchange (FX) trading, understanding, and managing market impact is becoming more critical for trading firms and broker-dealers. With the rise of electronification and the increasing complexity of liquidity landscapes, market impact has become a central concern, affecting everything from execution costs to liquidity quality.

Why market impact matters

Market impact directly influences the quality of liquidity trading firms receive. By keeping an eye on and managing market impact, traders can moderate it and reduce their average execution costs. In the short term, this helps monitor aggregate slippage at execution time. Over the long term, it serves as a reference for negotiating better pricing from liquidity providers, such as tighter spreads and increased skew.

Market impact is closely tied to a trader’s execution rate (or flow rate) and their interaction with liquidity pools. Traders who need to quickly enter a risk position based on a signal, or those managing market risk, might be reluctant to slow down their execution rate. In fast-moving and volatile markets, adjusting the flow rate might not always be a priority.

However, the impacts on liquidity are real. Liquidity providers (LPs) will widen their pricing to balance market impact and spread, which can result in the trader paying a premium for quicker execution. This might not be an issue for traders less sensitive to price, but those aiming for the lowest possible long-term execution cost need to manage this balance carefully. Long-term transaction cost analysis (TCA) often shows that the short-term fluctuations in profit and loss caused by managing market impact are overshadowed by the savings from reduced execution costs.

The effects of electronification on market impact

Electronification in the FX market has driven an increase in fragmentation of the market. It has led to an increase in liquidity providers that fiercely compete for flow and an abundance of multi-dealer platforms that aggregate and distribute liquidity. In turn, this has led to increased price competition and connectivity costs. Major liquidity providers have turned to increased rates of internalisation to stay competitive, therefore volumes on primary venues have decreased.

The result of this fragmentation is that market impact and information leakage become crucial to an LP. Improvements in technology mean the LPs have the data to show you where a trader or broker have directly caused market impact via their activities. As such, pricing of different flow profiles has become more disparate as LPs increasingly segregate impactful flows from benign flows.

At such a time when technology has reduced barriers to access liquidity, liquidity provision can be highly commoditised, with many platforms allowing traders to route trade flows across multiple liquidity providers and/or venues. The consequence is that it has become easier for users to interact with liquidity inefficiently. Liquidity is often recycled, and it is common for liquidity providers to see the fragmented pieces of a large parent order hitting their books via multiple clients and execution venues. These factors can significantly exacerbate market impact.

Impact of the US equity settlement cycle change to T+1

The change to the equity settlement cycle to T+1 is likely to see an increase in FX transactions outside of traditional peak volume periods. It is likely that we will see an increased amount of volume post 5pm New York, in what is often a quiet time zone in early Asia.

FX liquidity in this time zone is lean, and therefore in the initial stages of the change we expect to see more market impact, and therefore increased volatility during these hours. One could argue that FX transaction costs will therefore be higher. I disagree with this in the medium to long term. Liquidity begets liquidity, and the gap will be quickly filled as the increased trade flow presents a significant opportunity for liquidity providers. Some LPs will need to make small operational and technological tweaks to cater to the shift – and some are better placed to do so than others – but it need not be any different to the rest of the trading day in the end.

With our headquarters and APAC trading desk based in Sydney, Australia, 26 Degrees has a unique viewpoint on this shift. We have expertise in transacting during the early Asia session and are already advising clients on achieving optimal execution during these hours.

Measuring and managing market impact

There are many third-party vendors that allow firms to measure the market impact of their trading activity. These vendors and platforms are sufficient: They use appropriate benchmarks and are easy to use. However, market impact data is useless if it is not used or formulated in an actionable manner and combined with effective liquidity management. Again, Prime of Primes can assist in this regard.

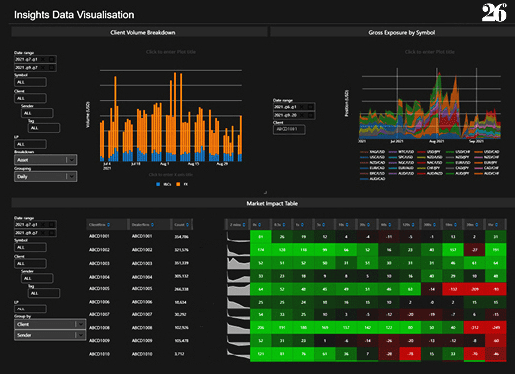

26 Degrees has developed a proprietary data analytics system (“Insights”) in-house that measures market impact across all client activity real-time. The data can be readily grouped and filtered across multiple facets of client activity (time, pair, size, client-tag, order type, market condition, correlations etc) – which allows our team to communicate openly with clients to easily identify subsets of higher impact order flows, changes to market impact profiles, and trends across liquidity pools/providers. We have developed functionality to generate alerts pertaining to flow quality, as measured by market impact, which enable us to deliver insights to clients that drive an improvement in their access to liquidity, and reduction in average execution costs and spreads.

Other platforms have continued to enhance their in-built analytics suites and the ease at which clients can access their own ‘raw’ data. This lowers the barrier to entry to managing market impact. It more readily allows takers to understand the value of their flow & the consequences of executing in a manner that does induce market impact.

Whilst data visibility is one factor, another is the accessibility of more advanced algorithmic execution models. LPs are distributing their proprietary algos more broadly across the market, including via API. In addition, third parties have access to sufficient data to benchmark these algos against one another, allowing users to select an appropriate algorithm more easily for their execution objectives – including execution/participation rate, product, and price.

In recent years, there have been several influential academic research papers published that investigate market impact, aggregator optimisation and price signatures. It has been fascinating to witness how this research is translating into the analytics suites of liquidity providers and their clients. The quant team at 26 Degrees has partnered closely with market-leading LPs in this space to develop advanced optimisation tools that improve the segregation of client flows and curation of liquidity pools. These tools contribute towards our clients accessing more competitive liquidity (lower spreads & execution costs) on a consistent, long-term basis.

Insights

Latest insights from

26 Degrees