Hedge Funds

Tier 1 Prime Broker relationships supporting three and four way give-ups

Synthetic prime offering

26 Degrees enjoys strong prime relationships with a panel of Tier-1 global investment banks including JP Morgan, Natwest, Standard Chartered, Macquarie and Cantor Fitzgerald, allowing our clients to benefit from superior access to global equity, foreign exchange, precious metals, index and commodity markets.

Asset Classes - Hedge Funds

Explore our Hedge Fund asset classes

Our clients have direct market access (DMA) to global Equity exchanges across 39 countries, allowing long and short trades directly to the underlying exchanges.

26 Degrees offers a comprehensive suite of five Algorithms.

Our Algo trading suites are available for use via DMA and our high touch / outsourced trading desks. Our primary Algo’s which can be accessed through IRESS IOS+ and Bloomberg EMSX.

Our FX and Precious Metals offering ensures our clients have access to world-class liquidity from more than twenty bank, non-bank and ECN liquidity sources.

Our proprietary Index and Commodity Synthetic products are structured by our in-house quantitative structuring and pricing team, providing access to a broad range of spot indexes with a fully transparent pricing structure.

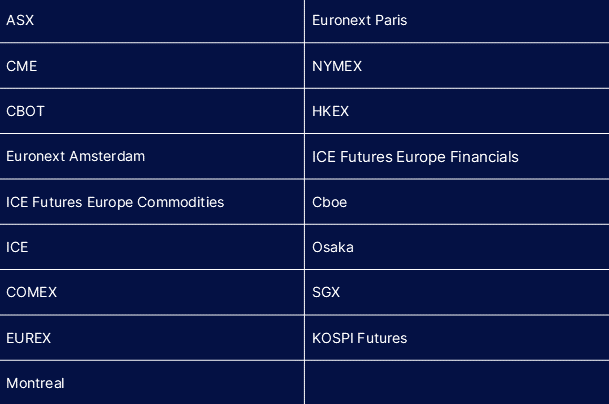

26 Degrees offers a suite of Synthetic Futures spanning 17 global exchanges, accessible via both Direct Market Access and high touch.

Why work with us?

Global market access

Direct market access to global Equity exchanges across 39 countries.

Capital Introduction Program

26 Degrees is focused on partnering with active family offices and emerging hedge funds.

Full service including 24/5 global coverage

With offices globally, 26 Degrees provides full 24 hour support five days a week.

Portfolio margining methodology

Access our transparent rules-based margin tool for your synthetic equity portfolio.

Extensive borrow availability

Robust global stock loan book.

Comprehensive Algorithmic suite

We offer a suite of comprehensive trading Algorithms and Direct Market Access (DMA).

Outsourced trading

High touch execution via our outsourced trading team.

Access to our global network of service providers

Expansive network of global hedge fund consulting services available.

Explore our Hedge Fund solutions

Exclusive Content

Interviews with our fund manager network

Industry Leading.

Globally Recognised.

We are active in ASX small cap stocks, so we value the excellent attention by 26 Degrees to this end of the stock market."

Insights

Latest insights from

26 Degrees