Liquidity solutions

Why work with us?

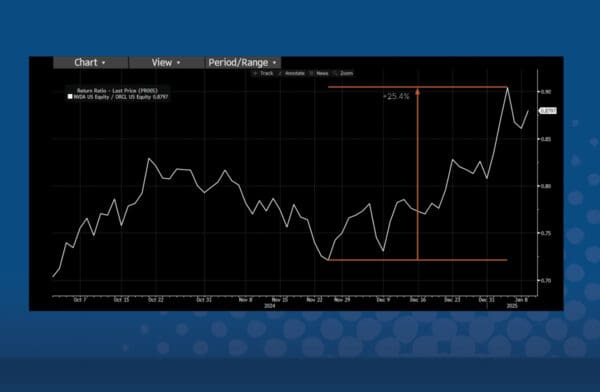

This provides our clients with crucial information, allowing for informed decisions on their trade executions and workflows.

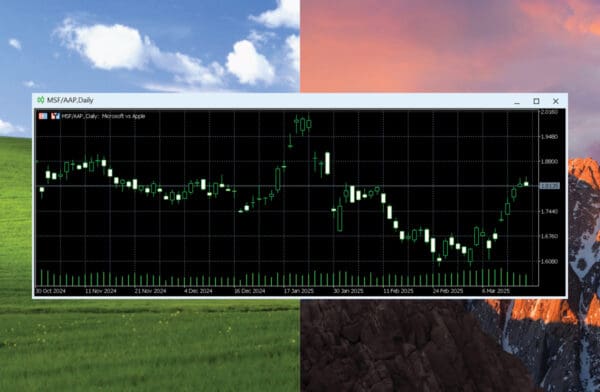

Seamless multi-asset liquidity

We are one of the few Prime of Primes that offers a truly seamless multi-asset liquidity offering covering pricing, market data and robust executions.

This is supported by a single, cross-collateralised margin account for maximum efficiency.

We customise for you

We focus first on the specific needs of our clients when constructing any new liquidity solution.

Whether it be price curation for your retail customer base, quote book optimisation for dealing desk hedge flow, or a multi-stream solution set-up to accommodate both flow profiles, we offer flexibility adapting to your unique requirements.

Low latency

With trading servers in LD4, NY4 and TY3, and pricing constructed from locally connected LPs and data vendors in each data centre, we are committed to delivering low latency pricing across all asset classes, no matter where you choose to locate your infrastructure.

Explore our Broker Dealer solutions

After winning FX Markets Asia Best Prime of Prime for 2023, the judges commented on our customer focus, noting that we stood out from the competition, providing more innovative, diverse services.

Tier 1 Prime Broker relationships supporting three and four way give-ups

Industry Leading.

Globally Recognised.

Insights

Latest insights from

26 Degrees