Benefits for brokers offering Soft Commodities

Soft Commodities, in the form of agricultural products such as coffee, sugar and soybeans, are one such product category that can offer a variety of benefits to brokers as well as their end clients.

Today, in the face of volatile market conditions, Prime of Primes (PoPs) must go above and beyond to deliver value to retail brokers. One aspect of this is providing a truly diverse, multi-asset product range Chief Commercial Officer, James Alexander explains.

How offering Soft Commodities can benefit brokers

“Soft Commodities are a strong addition to any broker’s product range,” Chief Commercial Officer, James Alexander explains, “in a crowded market, brokers are looking to stand out from the competition and products like soft commodities can be a key point of differentiation.

“The new products, as with all Index and Commodity CFDs, are covered under the 26 Degrees Data Usage Agreement, providing full exchange coverage and reporting. What makes these products even more attractive is that that have been added to the Market Data Rebate incentive with no additional volume required, making the incentive a very valuable benefit for our clients.”

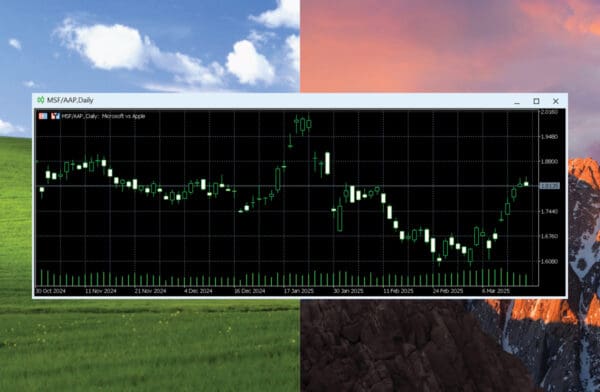

Clients that are attracted to the soft commodity range are often looking to deploy Futures style trading strategies into an API (or EA), native trading environment that CFDs platforms are well suited for.

Soft Commodities Trading and the benefits for end-clients

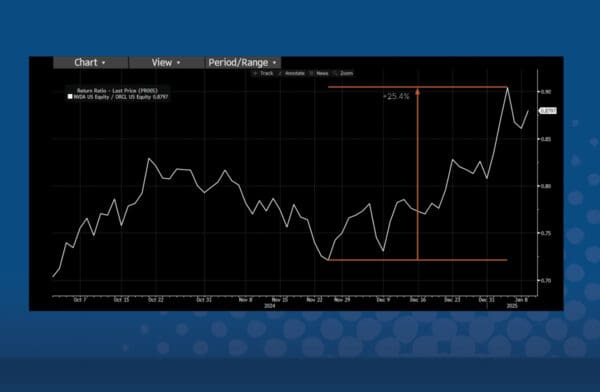

Soft Commodities are a great way to diversify portfolios in a volatile market. Recent developments in the Cryptocurrency market have shaken the resolve of many traders and is leading many active traders to return their focus to more traditional asset classes.

Soft Commodity prices are influenced by a wide range of factors, namely unpredictable weather, global demand, supply chain efficiencies and geopolitical upheaval, all of which have been in a period of volatility of late, creating both opportunities and challenges for the most risk tolerant traders.

Why choose 26 Degrees Global Markets?

26 Degrees Global Markets have introduced a suite of ten Soft Commodity CFDs, available to trade from our trading servers in NY4, LD4 and TY3. Priced on a spot (cash) basis, they complement our comprehensive range of proprietary Index and Commodity CFDs, increasing our product suite to 35 instruments that are derived directly from the underlying futures market.

James Alexander explains, “We are committed to leading the market in Index and Commodity CFD liquidity and our product expansion reaffirms this”.

26 Degrees Global Markets now offers a complete multi-asset liquidity solution, with over 70 FX and Metals pairs, 34 Index and Commodity CFDs and over 2000 Single Stock and ETF CFDs available within a single margin account.

To find out more about the 26 Degrees Global Markets Soft Commodity CFD offering click here.

Insights

Latest insights from

26 Degrees