Breaking down best execution metrics for brokers

What is best execution and why does it matter?

Best execution, at its core, is difficult to benchmark. In the current trading environment, it is well understood that determining best execution is not as simple as looking at a specific quotebook from a provider on any given day and seeing whether you got executed at the exact quote you tried to hit.

Best execution, or quality of execution, comes down to ensuring certain key elements of the execution experience are benchmarked and meet a fair level of performance over a number of trades. This number doesn’t have to be large. For example, an individual retail trader placing a dozen trades per month would be enough to start to build an assessment of performance.

26 Degrees Chief Commercial Officer, James Alexander discusses his view on what benchmark metrics can be used and why the quality of execution is crucial for Prime of Primes (PoPs) to focus upon given advancements in technology.

The fair market mid and hold times on execution

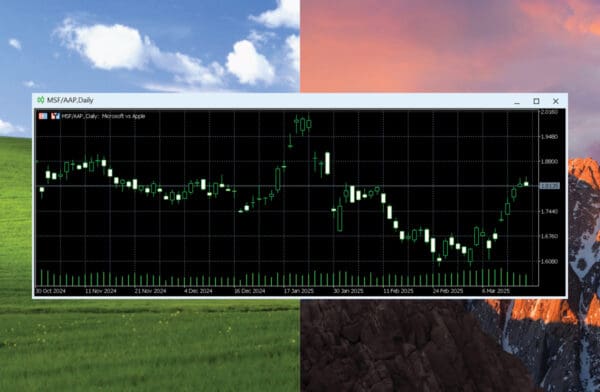

Acting as a reference point, determining the fair market mid at the point in time a retail trader entered a trade, is a key best execution benchmark to identify whether the price received by their liquidity provider was skewed.

Alexander (pictured right) explains, “With ample access to data available as purchasable packages from interbank venues and non-bank streams, the historical ticks for financial assets can be understood. A number of ECN venues will sell their top of book tickets which can also be used as a benchmark. Using the chosen source, the broker can then compare the market mid they are using as the benchmark and the price shown by their chosen execution venue.”

The average time an order is held at an execution venue is another metric that can be used. Not only in FX and Metals but also Index and Commodity CFDs, which can be subject to hold times depending on the execution venue a broker is using. Overall, this quality of execution is impacted.

VWAP slippage

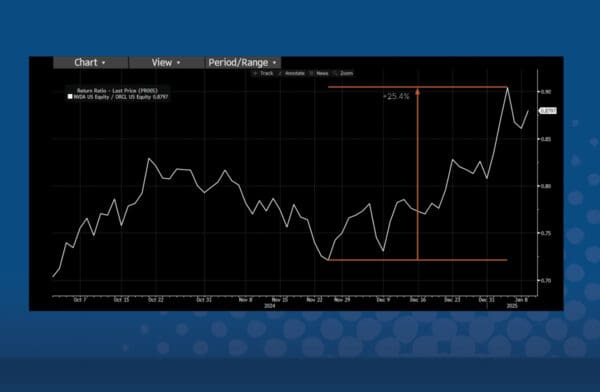

Volume weighted average price (VWAP) slippage refers to the measurement that shows the average price of a security adjusted for its volume. The importance of this metric lies in being able to assess where a retail client’s order should have been executed against any given quotebook on average and whether that particular trade is being filled at an accurate, fair and consistent VWAP rate when the order is above the top of book quantity.

This metric is not currently being well assessed at the retail broker level and there is significant room for technology to enhance visibility and transparency. This will improve conversations between retail brokers and PoPs, as well as retail brokers and their end clients. This level of analysis, coupled with increasingly sophisticated technologies at scale, will be a positive development for our market.

Technology supporting best execution and how

26 Degrees can help your business

Prime of Primes need to focus on quality of execution because those that don’t may be found out by the technology that is coming to market.

“At 26 Degrees, our clients have straightforward and transparent access to our group of liquidity providers across a range of asset classes. A client’s liquidity mix can also be tailored to suit their specific execution and trading preferences. We utilise the best technology to provide our clients with dynamic feedback into the nature of the flow profiles, as well as offering in-depth data analysis to allow for more informed decisions to be made,” states Alexander.

A suite of execution algorithms further supports this, allowing clients to achieve the best price with minimal value leakage. “With the right liquidity and execution methodology backed up with pre and post trade transparency, managers are clearly able to demonstrate best execution for their clients. We absolutely welcome the proliferation of this technology across the industry in order to encourage conversations around quality of execution,” added Alexander.

To find out more about how 26 Degrees Global Markets can help to grow your business and start a conversation, click here:

Insights

Latest insights from

26 Degrees