Did you miss these Pairs CFD moves? - December 2024: Part 2

What are Pairs CFDs?

Launched last year, Pairs CFDs by 26 Degrees are a completely new trading product built in-house for broker dealers, providing traders with the ability to trade any two instruments against each other as a single instrument, just like an FX pair.

Whether that be Metal vs Index, Commodity vs Commodity, Equity vs Equity, Pairs CFDs allow traders to go long in one instrument and short in another, creating a single leveraged position that is treated as a single trade. Importantly, this allows traders to easily set stop loss and take profit levels which are far more complex to set if managing two separate trades. Integration is also simplified due to the ability for Pairs CFDs to be streamed alongside all other 26 Degrees asset classes, via a unified API.

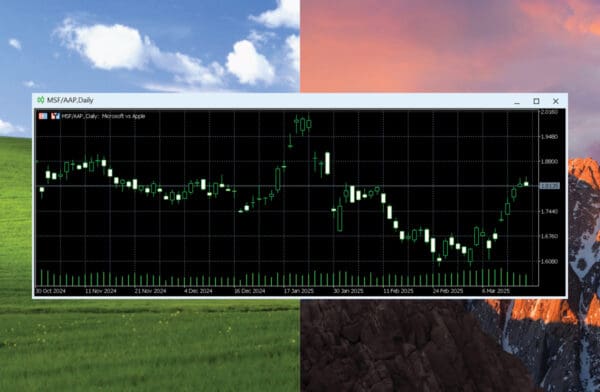

Amazon vs Home Depot (AMZ/HDT)

Fuelled by their advancements in AI technology and the buzz from a successful conference, Amazon saw growth in early December, while Home Depot struggled with high rates and weak demand. This divergence propelled the pair to climb 23.9% in mid-December.

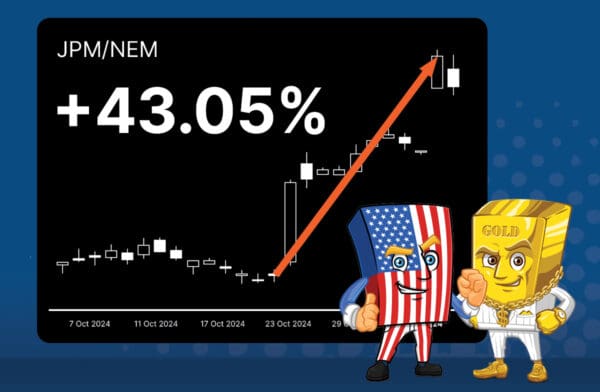

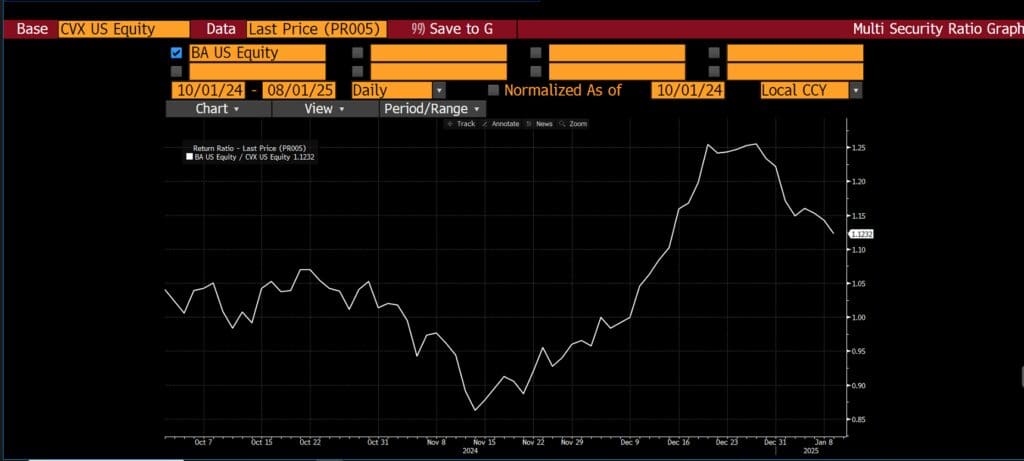

Boeing vs Chevron (BOE/CVX)

Boeing rebounded modestly in late November and December, driven by the resolution of labour strikes and operational improvements. In contrast, Chevron faced challenges with declining earnings, market underperformance, and institutional trading pressures. These contrasting trends propelled the pair up by 45.4% over a month.

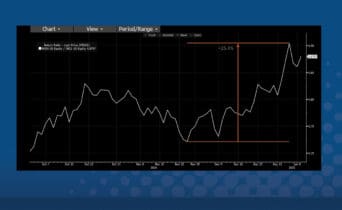

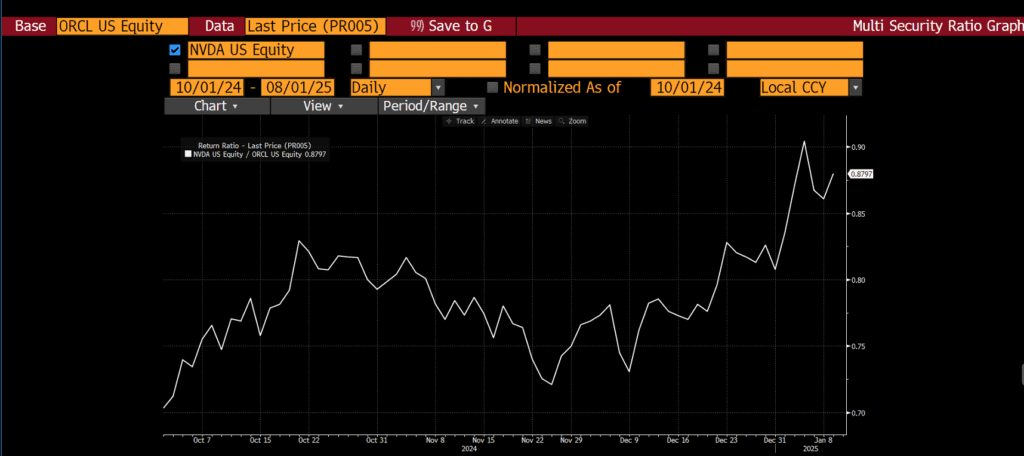

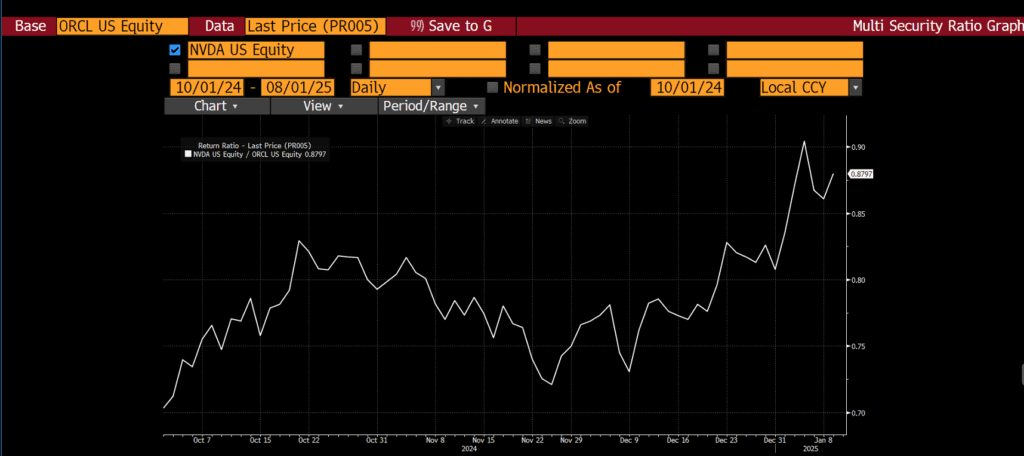

Nvidia vs Oracle (NVD/ORC)

Nvidia surged thanks to advancements in AI and strategic partnerships, while Oracle declined following an earnings miss and analyst downgrade.

Find out how 26 Degrees’ innovative Pairs CFDs may elevate your product offering today:

Learn more

Investments can go up and down. Past performance is not a reliable indicator of future performance.

Want to see more? Check out our LinkedIn Page: 26 Degrees LinkedIn

Insights

Latest insights from

26 Degrees

Industry Leading.

Globally Recognised.