Did you miss these Pairs CFD moves? - Election Edition

What are Pairs CFDs?

Launched earlier in the year, Pairs CFDs by 26 Degrees are a completely new trading product built in-house for broker dealers, providing traders with the ability to trade any two instruments against each other as a single instrument, just like an FX pair.

Whether that be Metal vs Index, Commodity vs Commodity, Equity vs Equity, Pairs CFDs allow traders to go long in one instrument and short in another, creating a single leveraged position that is treated as a single trade. Importantly, this allows traders to easily set stop loss and take profit levels which are far more complex to set if managing two separate trades. Integration is also simplified due to the ability for Pairs CFDs to be streamed alongside all other 26 Degrees asset classes, via a unified API.

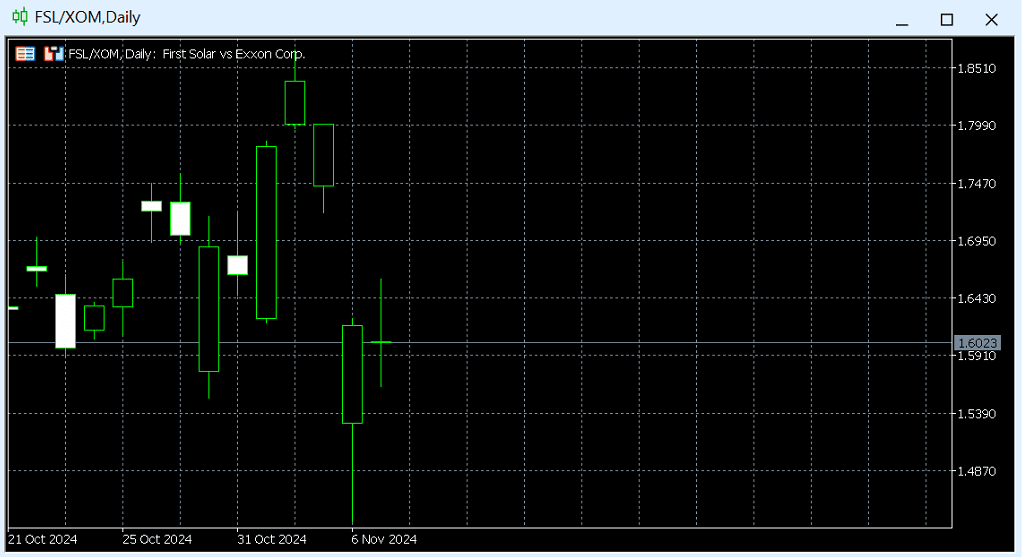

First Solar vs Exxon (FSL/XOM)

Renewables vs Fossil Fuels. With an expected rollback on renewables support following the US election outcome, the Pair saw a -10.14% day-on-day drop.

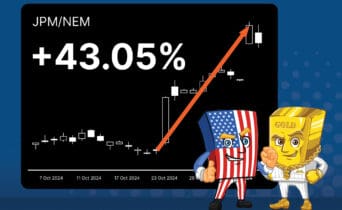

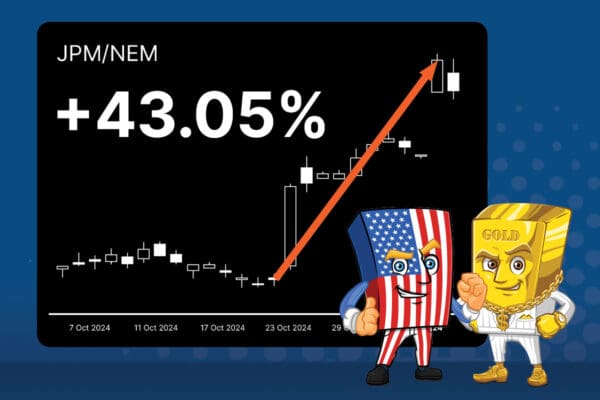

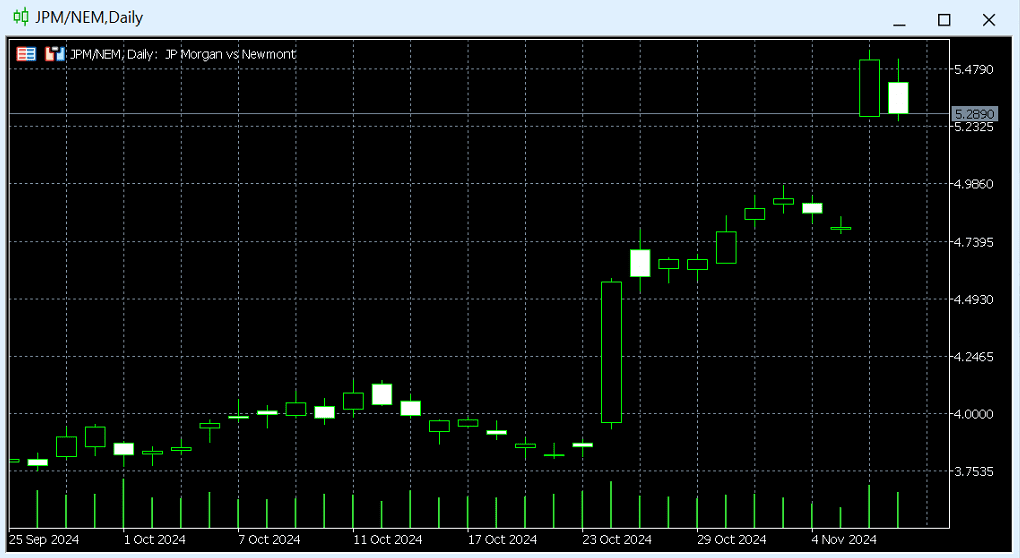

JP Morgan vs Newmont (JPM/NEM)

Expectations of a financial sector surge under pro-business sentiment drove a 43.05% increase in JPM/NEM over the two weeks leading up to the election.

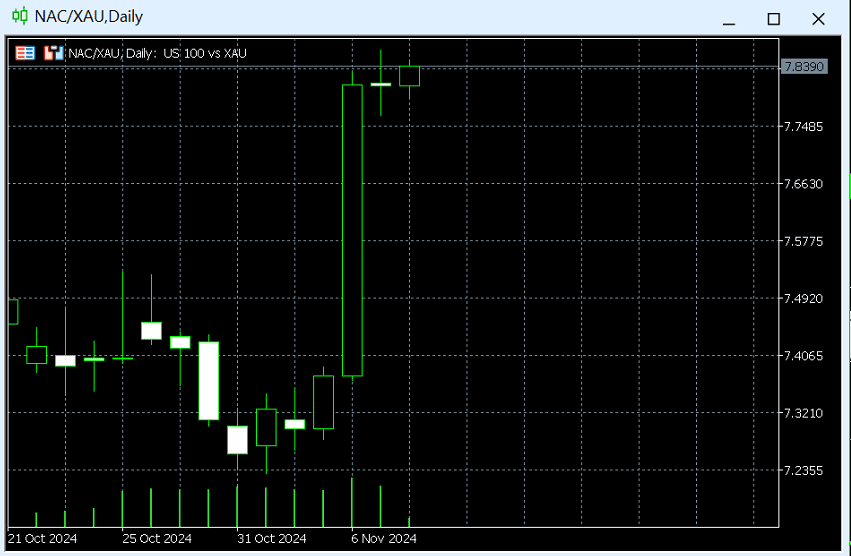

US 100 vs XAU (NAC/XAU)

Pro-business policies anticipated from the incoming Trump administration also strengthened USD and US indices, encouraging a risk-on sentiment. This weighed on XAU prices and drove NAC/XAU to a 5.90% day-on-day gain on November 6.

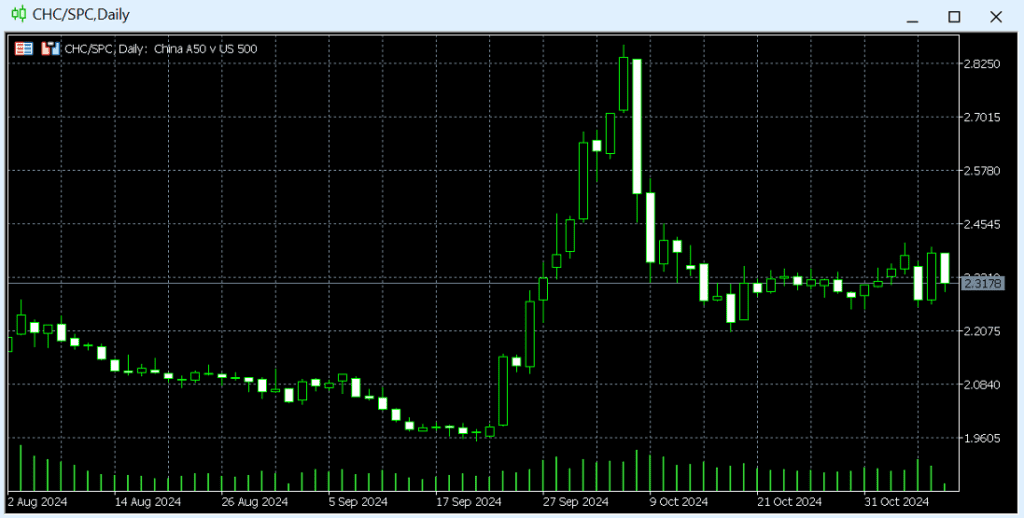

China 50 vs US 500 (CHC/SPC)

China’s economic slowdown, combined with expected US tariffs and protectionist policies, resulted in a 4.3% day-on-day drop for the Pair in early October.

Ensure your clients don’t miss out on future opportunities that may arise from market volatility. Find out more about how 26 Degrees’ innovative new product Pairs CFDs can take your product offering to the next level today: Pairs CFDs

Investments can go up and down. Past performance is not a reliable indicator of future performance.

Insights

Latest insights from

26 Degrees

Tier 1 Prime Broker relationships supporting three and four way give-ups

Industry Leading.

Globally Recognised.