Cutting through the noise: The future of Capital Introduction

The shifting landscape of Capital Introduction

The capital introduction landscape has evolved significantly in response to regulatory changes and shifting allocator priorities. Traditionally, capital introduction services were closely tied to prime brokerage relationships, which often catered to larger, well-established hedge funds and left many emerging managers without the same level of access to institutional capital.

However, allocators are increasingly recognising the limitations of traditional hedge fund strategies and are seeking exposure beyond conventional large-scale funds. There is a growing demand for specialised capital introduction services that can provide access to niche, uncorrelated strategies from emerging managers. These managers often operate in areas of the market that larger funds overlook, offering diversification benefits that appeal to institutions aiming to enhance their risk-adjusted returns.

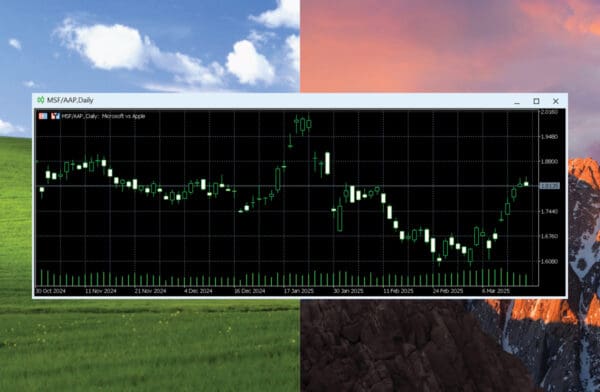

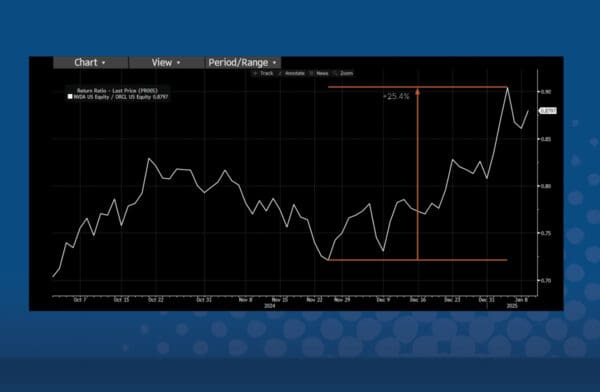

What we are also witnessing is a deliberate shift from some allocators away from exposure in US markets and other regions highly correlated to the US. This reflects a growing sense of caution among investors, especially considering recent macroeconomic uncertainties, inflationary pressures, and policy shifts.

The evolving nature of capital introduction underscores the need for a more tailored approach. One that extends beyond the conventional PB framework and focuses on connecting allocators with unique, differentiated investment strategies.

The Challenge – Navigating a crowded market

With thousands of hedge funds operating globally, the challenge for allocators is not just finding funds with strong past performance but identifying those with the adaptability and strategic edge to sustain long-term success. A more comprehensive evaluation considers key elements such as operational setup, risk management frameworks, and liquidity structure. Strong operational infrastructure is crucial, as funds with robust compliance, governance, and technology systems are better positioned to navigate market volatility and regulatory scrutiny.

The question remains…how can allocators efficiently cut through the noise and find managers with real potential?

How 26 Degrees can assist

At 26 Degrees, our approach is designed to cut through the noise of a crowded market by focusing on quality and alignment. Unlike traditional PB models where capital introduction is often tied to trading and financing relationships, our approach is completely independent. This ensures that we work with managers because we see genuine value in their strategies, not out of obligation, allowing us to introduce a broader and more unique range of potential opportunities to allocators.

We take a selective, relationship-driven approach, prioritising quality over quantity. Instead of mass distribution, we first take the time to understand allocator mandates, risk tolerances, and portfolio construction goals. This ensures that every introduction is highly curated and aligned with allocator needs, leading to more productive engagements and a higher probability of long-term success for both allocators and managers.

Our network spans APAC, Europe, and North America, including emerging markets, giving allocators access to a diverse pool of funds across different geographies and strategies. With offices in Sydney and Tokyo, we have a deep presence in APAC and a particular focus on uncovering emerging managers in the region, spending significant time on the ground to source differentiated strategies that might otherwise go unnoticed.

By combining independence and selectivity, 26 Degrees offers a more thoughtful, tailored, and value-driven capital introduction service that is designed to help allocators efficiently navigate a complex and evolving hedge fund landscape.

If you’re interested to learn more about Capital Introduction and what 26 Degrees can offer you, click the button below:

Found out moreInsights

Latest insights from

26 Degrees

Tier 1 Prime Broker relationships

Industry Leading.

Globally Recognised.